July 12, 2019

Will Bullen

Electric and Hybrid News

Government review tax for company car drivers choosing pure EVs and Hybrid vehicles

Following its review of the well-adopted WLTP vehicle testing procedures and the associated vehicle taxes, HM Treasury has revised the previously published Benefit-In-Kind (BIK) rates for 2020-21.

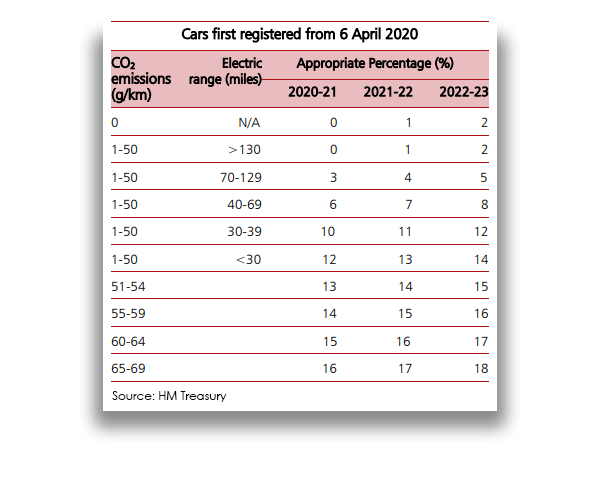

The revision sees two new BIK rate tables; one for drivers of a company car registered before 6th April 2020, and one for cars registered after this date.

HM Treasury has stated that for cars registered on or after 6th April 2020, most company car tax rates for vehicles with CO2 emission of 95g/km, will be approximately 22% - a reduction of 2% from their original statement.

The BIK rate is then expected to be increased by 1% each year for the following two years, eventually matching the 24% originally proposed.

Vehicles registered before the next tax year begins and have a CO2 emissions measurement of 95g/km will be subject to the full 24% for all three tax years.

However, the biggest news comes for zero-emission vehicles. Pure electric vehicles (EVs) that have 0g/km of CO2 emissions at the exhaust, will be granted with a 0% BIK rate for the 2020-21 tax year; regardless of when the vehicle was registered.

This means that company car drivers will pay NO company car tax at all.

The full tax relief only lasts for the year. The BIK rates then reappear and rise to 1% and 2% in 2021-22 and 2022-23 respectively. However, this is still a substantial discount and a phenomenal incentive for company car drivers to opt for more environmentally friendly options.

The 0% rate will also apply to company cars registered from 6th April 2020 with CO2 emissions of 1-50g/km and has a pure electric mile range of 130 miles or greater.

From 2023-24, we will see a return to one BIK tax table for company fleets, as the rates are reassessed. As of writing, no update has been given on the expectation of BIK rates from 2023-24.

The Government has stated that by “providing clarity [on the] future [of] the appropriate percentages, businesses will have the ability to make more informed decisions about how they make the transition to zero-emission fleets”.

On the review of the appropriate “The Government aims to announce appropriate percentages at least two years ahead of implementation to provide certainty for employers, employees and fleet operators.”

Earlier this year, the vehicle fleet industry was asked to respond to a series of questions regarding vehicle tax changes and whether they are required, once the Worldwide Harmonised Light Vehicles Testing Protocols (abbreviated to WLTP) are adopted for tax purposes from April 2020.

Initial evidence, provided by manufacturers, suggests that over 50% of car models will see an increase of registered CO2 emissions. Currently, this increase is approximately 10-20% from the previous NEDC-tested values and the new WLTP-related readings.

The Government hopes this new approach avoids the potential increased tax liability for company car drivers and fleet operators that would have been caused by this increase.

The 4% diesel premium on published BIK rates remains, but cars classed as RDE2 will still be exempt from the charge.

Jay Parmar, Director of Policy and Membership for the BVRLA, recently said, “Recognising the value of the company car market in supporting the transition to zero-emission technology is a positive endorsement for our sector, showing refreshing alignment between Government’s environmental and fiscal policies.

Mr Parmar continued to say, “The Treasury is giving back some of the unfair company car tax windfall it was set to receive as a result of WLTP and providing some essential extra visibility on future tax costs for those looking to order their next vehicle. This is a good day for company car drivers and our members.”

However, these new changes do not affect the lease rental restriction, capital allowances or any other CO2 related taxes and incentives but will include the fuel benefit charge.

Existing vehicle excise duty (VED) rates, which was not part of this review, will remain the same from 6th April 2020, despite the introduction of WLTP values for tax purposes from this date.

The Government has announced that a call for evidence for VED will be published later this year, as they look towards a “more dynamic approach to VED” that will recognise smaller changes in CO2 emissions.

Here is a breakdown of all the new BIK rates for the next three financial years: