Fleet Vehicle Supply

There are many different methods of sourcing vehicles for your fleet and this collection of guides will cover each of them helping you decide which are the best options for your fleet.

Whether you’re updating your existing fleet or looking to expand it, Wessex Fleet is here to help. We work with dealers across the country in order to be able to find you the exact vehicle that your fleet needs. We can help arrange a number of different funding options in order for you to finance any new vehicle, including business car leasing and contract hire.

We work with the UK’s leading leasing funders in order to be able to provide you with highly competitive, fixed, low monthly rental rates for cars, vans and even minibuses. We can provide you with lease agreements of variable lengths and bespoke contract hires to suit the individual requirements of your business needs.

Contract hire is a type of leasing agreement, and business contract hire is designed for companies.

Leasing is essentially a long-term rental, where you are able to keep a vehicle for a set period of time and pay a fixed monthly cost for the rental duration.

When you reach the end of a contract hire agreement on a vehicle we can arrange for it to be collected on the same day as your new vehicle is delivered if you decide to take another vehicle to replace it.

Finance Lease

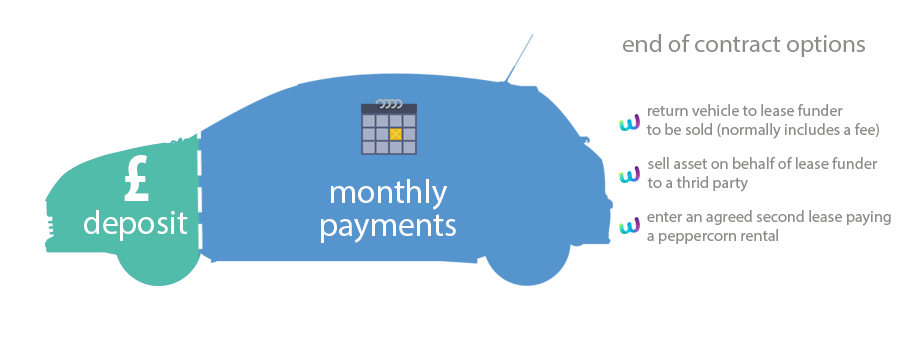

Finance lease is similar to a contract hire lease in that the agreement lasts a set period of time and there are fixed monthly costs.

However, unlike a contract hire agreement, a finance lease allows you a number of different options at the end of the agreement.

You can choose to return the vehicle to the lease funder to be sold, sell the vehicle on behalf of the funder to a third party, or enter an agreed second lease paying a peppercorn rental.

Finance leasing involves a proportion of the vehicle, including interest and costs, being charged back over a fixed period of time with monthly payments.

As part of a finance lease agreement you can choose to pay either the entire cost of the vehicle, including interest, over the monthly payments or you can opt for lower monthly payments with a final balloon payment that is based on the anticipated resale value.

During the agreement, the vehicle will remain the property of the lease funder however it will show as an asset on your balance sheet.

A VAT registered company can reclaim between 50% and 100% of the VAT paid on a finance lease, depending on whether it is a car or commercial vehicle, and your payments can normally also be offset against taxable profits.

Finance leasing is an option that is only open to businesses and we can help you decide whether it is the right choice for your fleet needs.

Wessex Flexi Funding

Wessex Fleet can also offer a fully bespoke funding package exclusively to our corporate customers.

We do this by looking at market and vehicle data sources so we are able to offer you the best price and terms on for Wessex funded vehicles on a lease contract tailored to your specific needs for that individual vehicle’s requirements.

This contract works very similarly to long term hire, with contract terms varying between 20 days and 48 months. In some cases, we can offer this with no termination fees if a vehicle needs to come back early.

We have created our own funding options so that we can help our customers grow their companies while limiting the long-term risk for them on finance products.

Contract Purchase

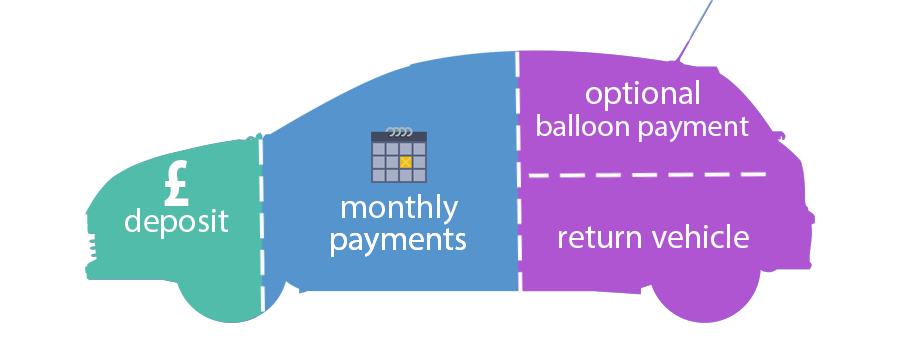

Another way to add a vehicle to your fleet is through a contract purchase.

A contract purchase is where you pay a deposit and then a fixed monthly cost for a set period of time-based on the vehicle’s value. When you reach the end of the contracted time you will have the option to purchase it for a pre-agreed balloon payment or to return the vehicle to the funder.

One of the main benefits of a contract purchase is that if you decide to buy the vehicle at the end of the contract then you already know the balloon payment amount, and so can budget accordingly for this.

The vehicle will be an asset to the business on your balance sheets and can be an efficient form of funding for VAT-restricted businesses needing commercial vehicles.

With contract purchase, you are still subject to excess mileage charges and return conditions if the vehicle is not kept by the business.

Outright Purchase

Some businesses decide that the right choice for their fleet, or at least for particular vehicles in it, is to make an outright purchase.

Due to our high volume of vehicle purchases, Wessex Fleet are able to secure significant discounts for our customers when we help with the purchasing process for any new vehicles. Whether you need a car, van or minibus we can offer you a quote for any make, model and specification.

Wessex Fleet works with a network of trusted dealers to get the best price possible from a reliable and reputable source.

Long Term Car/Van Hire

At Wessex Fleet we know that you don’t always need or want a vehicle that you’re committed to with a contract, which is why we also offer long-term rental solutions.

If you have a new starter, there is a gap between old vehicles leaving and new vehicles arriving, short term contracts, or vehicles that you want to be able to return at any time then business car rental is a great choice.

Wessex Fleet have an online booking tool that’s straightforward to use. You can quickly send our rental team an online request and they’ll then go and find the best vehicle for you.

We work with a number of suppliers so we can offer you a huge choice of cars, vans, and minibuses at competitive rates.

Employee Benefits

Another way for businesses to arrange vehicles for their staff is through employee benefits. We are able to arrange outright purchases and various finance packages for your employees.

Our buying power allows us to source new vehicles at heavily reduced prices for your drivers.

Why Should I Choose Wessex Fleet?

Wessex Fleet can offer you and your business a bespoke and personalised service as we know that every business is different, so their needs will also differ.

We currently have a team of over 30 people across all our departments including fleet operations, customer services, rentals, accounts and compliance, marketing and pricing and leasing sales to help ensure we can service your business needs.

To find out more about our history click here or visit our Meet the Team page to see the faces of our team.

What is the Advantage of Having a Panel of Finance Providers?

We have a panel of funders so that we can always access the most competitive rates in the market at any time.

Providers that only have access to one or two funders can only offer you their very best rates, whether Wessex Fleet can go to 6 of the biggest funders and ensure that customers have the best rates.

This helps with bigger fleets as they will need replacing at different times, we can ensure funders work for your business and show you a good saving.

Is Contract Hire the Best Solution?

While we are happy to provide you with any service you request, we always recommend Contract Hire as the best solution.

Contract Hire provides businesses limited risk during the life of the contract, fixed monthly payments allowing for controlled budgets and no risk on the vehicle deposal when the vehicle is returned at the end of the contract.

What Types of Vehicles Do Wessex Fleet Provide?

Yes, we can provide and manage any type of vehicle for your fleet of up to 3.5 tonnes, whether you are looking to purchase or lease, and this includes:

If you want to discuss your fleet’s new vehicle needs then please call on 01722 322 888.

Is Contract Hire an Operating Lease?

Contract hire is a type of operating lease which allows a business to use the vehicles for a set period without the stresses of ownership. Operating leases like contract hire agreements are great for businesses due to their flexibility, the low fixed monthly payments and no depreciation worries.

Can I Get a Business Contract Hire Deal?

Yes, we offer business car leasing and contract hire deals to help your company hire the vehicles needed to reach your daily goals. Our rates are fixed at a low rate for your full contract, with a huge range of cars, vans, minibuses and more ready to be leased. Head over to our available vehicles page to browse through a list of models.

How Long Are Your Business Leasing Terms?

At Wessex Fleet, we offer flexible business leasing contract lengths ranging from 12 to 60 months, or two to five years. You can choose the option that suits your needs, and our team will work with you to get the perfect deal.

Do I Have to Lease or Buy Vehicles from Wessex Fleet to Use Your Fleet Management Services?

Although we do offer the facility to source lease and outright purchase vehicles for your business you do not have to use this service for us to be your Fleet Managers. Many of our customers source their vehicles or have alternative supply arrangements.

We can provide the tools needed to manage costs while ensuring your drivers and vehicles are well looked after.

Our full range of fleet management services could be ideal for your business.