December 1, 2020

Abby Nuttall

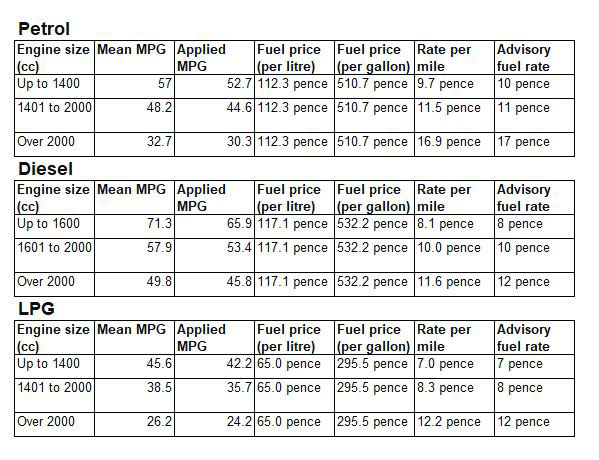

Advisory fuel rates are used for employers to reimburse their employees for business travel in their company car or for employees to repay the cost of fuel they’ve used in a company car for personal travel.

The latest rates to be published by HM Revenue and Customers apply from today (the 1st of December), but they have advised you can use the previous rates for up to a month so until the 1st of January 2021.

There is only one change from last quarter’s rates previously published on the 1st of September, and that is a drop of 1p in the rate for cars with petrol engines between 1,401 cc and 2,000 cc to make it 11p per mile.

All other rates remain the same, including the electricity rate for fully electric vehicles at 4p per mile. For the purpose of these rates, hybrid cars are treated as either petrol or diesel vehicles.

Below are the current rates: