October 29, 2021

Abby Nuttall

On Wednesday Chancellor Rishi Sunak announced the Autumn 2021 budget for the UK and there are several points of interest for us and our fleet customers.

We’ve rounded up the main items that could have an impact on your fleet below:

- Company car tax

- HGC VED

- HGV road user levy

- Fuel duty rates

- Vehicle excise duty rates

- Van benefit charge

- Car and van fuel benefit charge

Company Car Tax

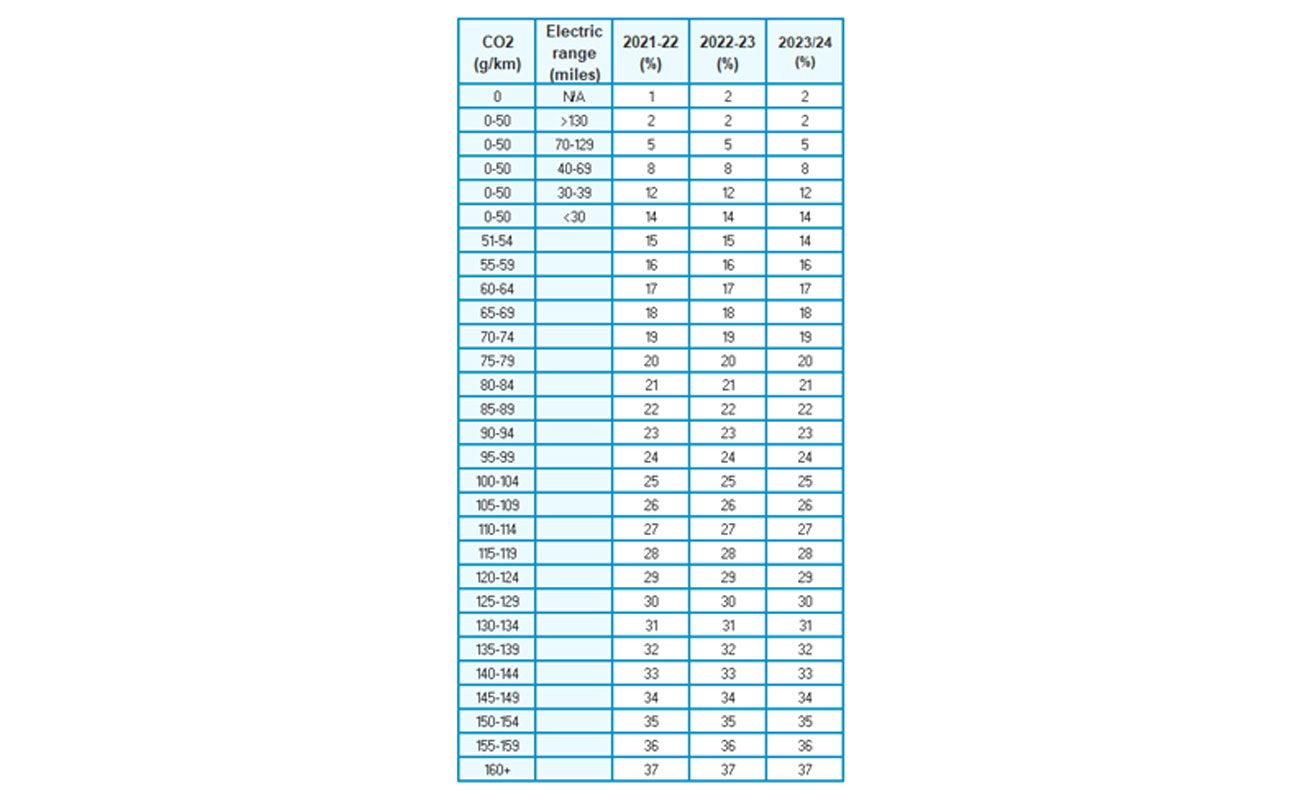

In the Budget the Chancellor confirmed that the company car tax rates that have been announced for 2022 / 23 will remain frozen at the same rate for the following tax tear of 2023 / 24.

There was no further information on the years of 2024 / 25 and onwards like some hoped.

The rates will be frozen at:

HGC VED

The vehicle excess duty for HGV owners will continue to be frozen for the tax year of 2022 / 23.

HGV Road User Levy

The road user levy for HGVs is being suspended for an addition twelve months from August 2022 so no HGV owner will be liable to pay this until August 2023.

The levy is a charge on all vehicles weighing 12 tonnes and more driving on UK roads and needs to be paid by any vehicle that weighs this much, even if they are operated by a foreign company.

The levy is £10 a day up to £1,000 a year per vehicle.

Fuel Duty

Fuel duty will remain frozen for the twelfth consecutive year at 57.95 pence per litre.

With the forecourt price of fuel based on fuel duty, product cost, VAT and the retailer’s margin and us seeing a rise in the product cost currently this is good news for all drivers of petrol and diesel vehicles.

Vehicle Excise Duty

Vehicle excise duty, also known as road tax, will rise in line with inflation (RPI) from the 1st of April 2022.

This will apply to all cars and light commercial vehicles.

Van Benefit

The van benefit charge is the figure that is used to calculate the amount of tax paid by employees and employers when they are able to use a van provided by the business for personal travel.

The amount is a flat rate that is then multiplied by the driver’s personal tax rate to calculate the tax they will pay.

From the 6th of April 2022 this will increase to £3,600.

Car and Van Fuel Benefit

Businesses may also offer drivers the use of a company fuel card for personal travel and when this occurs there is also a tax payable for both employee and employer again.

The multiplier for car fuel benefit will increase to £25,300 and for vans the flat-rate charge will rise to £688 to rise in line with consumer price index rise.

This rise will again be implemented on the 6th of April 2022.

Additional Decarbonisation Funds

The government has committed to an additional £620 million in additional funding to support the end of selling new petrol and diesel cars and vans. This money will be used to fund residential public charging units and targeted plug-in vehicle grants to help with the cost of home and workplace charging units.

We’ll keep you updated as more impacts are revealed from the latest budget announcement.