January 13, 2022

Abby Nuttall

Driver Articles

You might have read a lot about the low benefit in kind (BIK) rates that electric cars and vans have, but do you what these rates are and how they’ll change in the coming years as electric vehicles (EVs) become the norm? Don’t worry if your answer’s no – we’ve got all the answers in the article below!

What is Company Car Tax?

Company car tax is a tax that you pay for the use of a vehicle supplied by your business for you to use on personal journeys.

Lots of companies choose to offer their employees a car as a perk for particular roles and it is important that if this is offered to you then you consider the options available, especially if they offer multiple car benefits for you to choose from, and whether they will work in your best interests.

If you have a van supplied by the business and use this for personal journeys then the tax you will pay for this is different as it is based on a fixed value rather than a variable one.

How is Company Car Tax Calculated?

It is calculated based on three things:

- The P11D (vehicle value)

- The BIK rate

- Your personal tax band

The P11D is the vehicle’s value and includes any additional features you add to the basic model, but does not include the non-taxable parts such as the first year’s road tax and registration fee.

Your personal tax rate is the amount your income is taxed at which will usually be 20, 40 or 50 per cent.

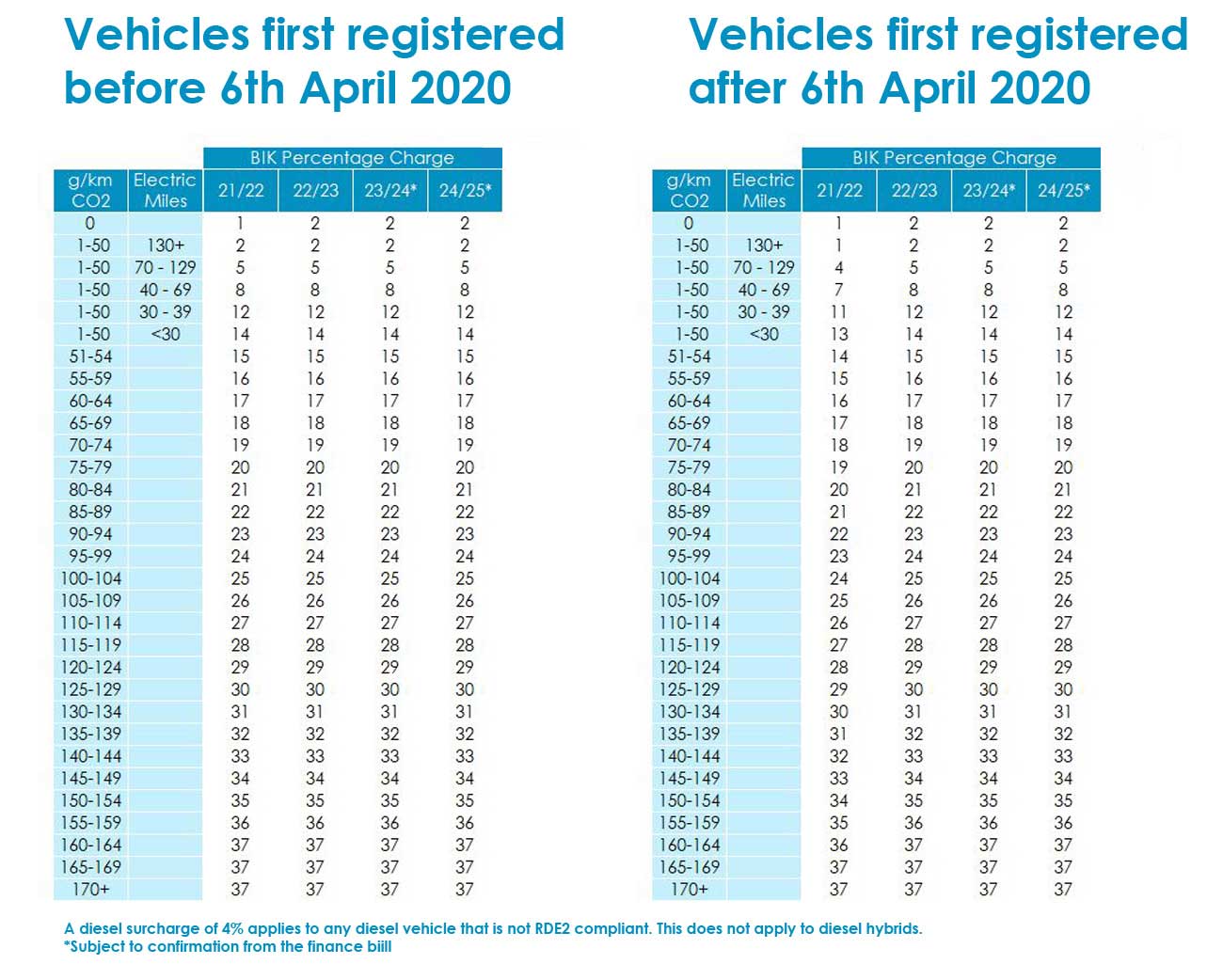

The BIK rate is based on the CO2 emissions of the vehicle. As you can see in the table below the amount you pay increases as the pollutants the vehicle emits does.

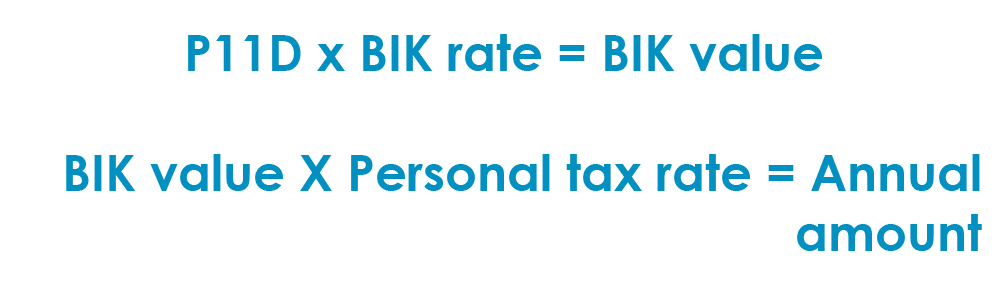

To calculate the amount you will pay in company car tax just use the simple sum below:

To get your monthly payment amount, which will be deducted from your paycheque, then you just need to divide this by 12.

When Do I Pay Company Car Tax?

Company car tax will usually be taken from your monthly salary before it is paid to you, just as any other BIK tax you receive. This means that when you are considering if a company car is the right choice for you then you should consider the impact on your take-home pay and the knock-on effects on your monthly budget.

What is the Current Company Car Tax on EVs?

Company car tax rates, also known as benefit in kind (BIK) rates, run on the UK tax year which is April to April. This means that whenever you see a tax year it will show as something like 2019/20 which means it runs from April 2019 to April 2020.

We are currently in the tax year 2021/22 which is the first year that drivers will pay a company car tax on an electric vehicle but it is only at 1%.

Is Company Car Tax for EVs going to rise?

The Government has committed to keeping the BIK rates for pure EVs low until 2025 to encourage the uptake of electric models from businesses and their employees who drive company vehicles.

The rates will rise slightly over the next few years but remain extremely low compared to hybrid, petrol and diesel models.

In the table below we’ve mapped the currently advisory company car tax rates for the current year as well as the next three.

Company Car Tax on Hybrid Vehicles

The amount of company car tax you pay for a hybrid not only depends on its emission levels but also how far it can travel on a purely electric range.

This is again designed to encourage drivers to take up hybrid models with higher electric ranges which reduces the pollution they contribute.

The amount of company car tax you will pay on a hybrid is higher than a pure EV as it does produce pollutants when it is using the combustion engine rather than the electric motor.

More EV Info

If you want to find out about electric vehicles in general, how charging works and what affects the range then take a look at our dedicated EV guides.