For a lot of businesses offering a company car and van scheme is not just a perk they can offer their employees but is essential. This is especially true for companies where transport is a necessary part of the job, like those who need to travel for client meetings or need a van for building or repair works.

Other businesses choose to offer a company car scheme to their employees as part of their employee benefits as a perk for drivers who do not need a vehicle for business use.

This guide is designed for businesses and employers but if you’re an employee and want to learn more about company car schemes then take a look at this one.

What is a Company Car Scheme?

A company car scheme is a programme where you offer your employees the use of a vehicle that is funded by the company, or funds to help them finance a vehicle in their own name.

Types of Company Car Schemes

There are several types of ways that you can offer a car through a company car scheme to your employees and these include:

When looking at offering a company car scheme you will want to consider the above financing methods and which one or which combination will work best for your business and your drivers.

We’ve broken down each of these funding methods below in order to help you understand them all and choose the right options for your business.

With a salary sacrifice scheme the vehicle will be in the business’ name but the employee will fund it through a reduction in their salary.

Your employee will still need to pay company car tax on the vehicle but because the cost of the benefit is deductible from the employee’s gross salary before statutory deductions means their income tax and national insurance contributions will be lower.

Depending on the vehicles you choose you can get a company car tax rate as low as 1% on a fully electric vehicle, which means a lower Class 1A national insurance bill for your business. Lower company car tax rates also mean that drivers are more likely to take a vehicle with low CO2 emissions which also helps your employees as taking a car benefit can have a lower amount for the benefit in kind (BIK) tax compared to the equivalent salary taxed at 20% or more.

A salary sacrifice scheme allows you to introduce the benefit of company cars, either to all or select employees, without increasing the business’ overall wage outlay.

It also encourages drivers to choose low CO2 vehicles which helps reduce your company’s overall CO2 emissions and enhances your green footprint.

When deciding if a salary sacrifice is right for your business you need to consider a number of things including what your staff turnover is. As if there is a high turnover then you will need to consider what to do with the vehicles when members of staff are no longer with the business to use them. If your method of funding the vehicle is leasing and you want to return vehicles before the end of the contract then there will be an early termination cost to them.

You will also want to consider the salary of your employees, as if a number are paid minimum wage then the scheme will not be cost effective as they won’t have enough salary to sacrifice.

Another option you might choose for your company car scheme funding is a finance lease.

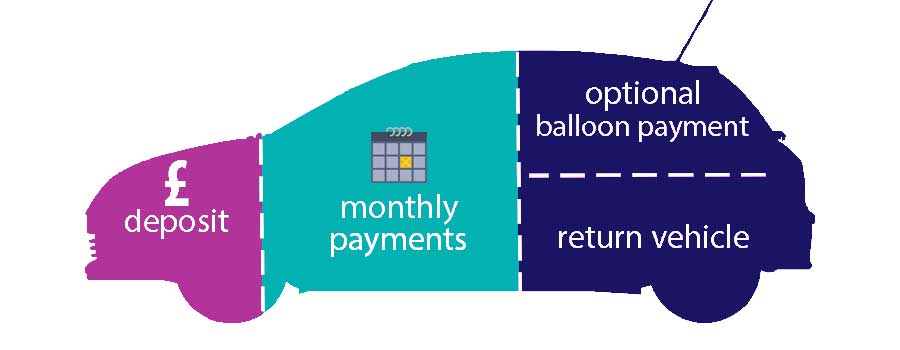

A finance lease includes a proportion of the vehicle, including interests and costs being charged to the user over a fixed period of time with monthly payments. You can choose to pay this entire cost over the duration of the agreement, or to have lower monthly payments and a balloon payment at the end of the lease, which is based on the expected resale

Finance leases allow you to show the vehicle on your balance sheet, and the outstanding rentals will be shown as a liability. This can be beneficial if you expect the tax relief for depreciation to be greater than claiming a capital allowance.

A finance lease allows you to lease a vehicle but also offers you a number of different options at the end of a lease. You can return the vehicle to the funder, sell it to a third party or enter a second lease with a peppercorn rental.

Business contract hire is the most popular method of funding a company car scheme as there are many benefits to it and fewer risks than some of the other options.

You can budget accurately based on monthly rentals, which can include a maintenance package that will cover most maintenance work, servicing and wear and tear repairs.

Contract hire is a great choice for businesses as it allows you to set the terms of the agreement, including the vehicle, lease length, and annual mileage.

Other benefits include that you can deduct some of the cost of finance rentals from taxable profits of the vehicle and depending on the CO2 levels this can be up to 100% of the payments. You can also reclaim VAT on the payments, which is either 100% for vehicles used solely for business travel 50% for vehicles that are used for personal journeys as well. In either circumstances, if you add a maintenance package to cover the vehicle then you can also reclaim all of the VAT for these payments.

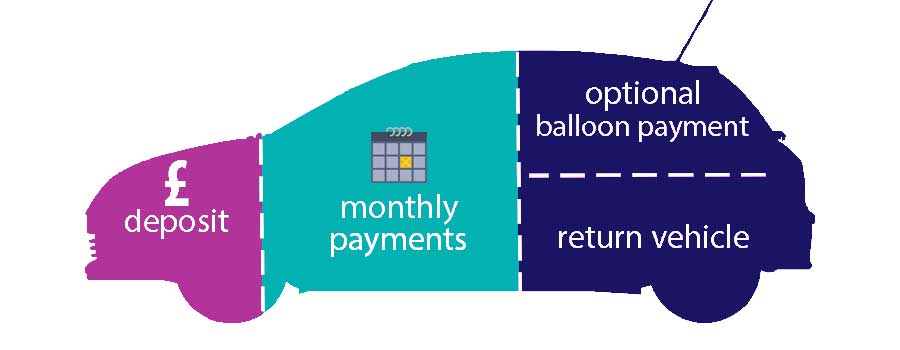

Similar to contract hire, contract purchase gives you the benefit of a fixed monthly rental cost and all the budgeting benefits that brings you.

With a contract purchase the vehicle appears on the balance sheet, so you can claim capital allowances, and the finance payments are not subject to VAT. There’s the additional benefit of VAT not being charged on these payments that if you are unable to recover VAT you will still not have to pay it.

A contract purchase agreement differs to a contract hire in that you have the option to purchase the vehicle at the end of the contract, provided all other terms of the agreement have been met. The amount you pay for the vehicle at the end of the agreement will already be agreed upon when you take out the contract so you will know the expected payment if you would like to purchase the vehicle. This allows you to budget for the purchase if you decide to go ahead with the balloon payment.

Alternatively, like you would with a contract hire you can choose to return the vehicle at the end of the contract and no longer be responsible for it. If you do decide to return the vehicle you will need to return it in a condition in line with the funder’s fair wear and tear guidelines as well as any other agreed conditions.

You might decide that purchasing the vehicle outright is the best option for your company.

If you purchase the vehicle then the primary benefit for the business is that the vehicle is company property from day one, and you have complete control over its use and do not need to be as concerned about charges for wear and tear or excess mileage when the time comes to hand the vehicle back.

You will also be responsible for the servicing, maintenance and MOTs that the vehicle requires. Depending on the size of your fleet and how many vehicles you purchase then management of them can be more time consuming and expensive as well.

The purchase and work required on the vehicle mean that it will be a regular draw on the company’s finance, and the amount will be irregular and unpredictable depending on the work required.

Alongside this, the tax deductible capital allowances are capped at 25% of the vehicle value or a maximum of £3,000 depending on which is higher.

Employee Car Ownership Scheme

An employee car ownership scheme is one where the employee is given a monthly cash allowance in order for them to pay for a vehicle in their name.

Each allowance will be slightly different as they are worked out for the individual driver based on the car grade, their tax bracket and the annual business mileage.

Employee car ownership schemes are slightly different to offering the employee a simple cash allowance, as it helps support your duty of care, with the responsibility of servicing, maintenance still with the business. It also places a level of control on how the allowance is spent, and you can introduce additional controls for health and safety reasons or added incentives, for example if drivers opt for an electric option.

For your employees there is built in insurance that protects them from the loss of the vehicle or a change in personal circumstances, which makes it a low risk scheme for them.

HMRC have confirmed that the money paid to the employee under an employee car ownership scheme is not subject to BIK company car tax.

If you have any questions about any of the above options or want to talk to someone about your needs and which would be the best option for you then please give us a call on 01722 322 888 or check out our vehicle supply page for more info.

What are the Advantages of Running a Company Car Scheme?

There are a number of benefits that come from offering a company car scheme to your employees whether a vehicle is necessary for them to do their job or not.

It’s a controllable reward scheme that will not increase the business’ wage and pension bill, that can boost existing staff morale and be an additional perk to entice new recruits.

It can cut your national insurance contributions depending on the scheme you opt for but there is no impact on the employee’s national insurance contributions.

Depending on the scheme you opt for you can also claim capital allowances and reduce the business’ taxable income.

You might choose to add advertising or branding to company vehicles which can help increase your brand awareness amongst the areas that they drive. For more information on signage then take a look at this guide we’ve put together.

Choosing low CO2 emitting or electric vehicles can help reduce your company’s overall carbon footprint.

Are there Any Disadvantages of Running a Company Car Scheme?

Although there are many benefits to having a company car scheme there are still some careful considerations you will need to make when deciding if it is the right choice for your business and which option is the right one for you.

You will be responsible for a fleet of vehicles no matter which method you choose, and this will take time and money to manage. You might want to consider a fleet management service to help you with this and Wessex Fleet are able to offer you a tailored service for your business, saving you time, money and running an efficient and effective fleet. If you’d like to find out more information about how Wessex Fleet can assist you, just click here to visit our fleet management page.

If you decide purchasing vehicles is the right choice for your business or at least part of its fleet then you will be responsible for registering and taxing the vehicle.

You will be responsible for making sure your vehicles are in a road worthy condition, fit for purpose and that any maintenance, servicing and MOTs are completed in line with manufacturer and funder recommendations. Depending on the scheme you opt for you will also be responsible for insuring the vehicles.

For your employees they may need to pay company car tax on a company car vehicle and this may be a deterrent if not properly explained to them.

Your employee can walk away from the benefit with no penalty to them, which could leave you with a vehicle that needs to be reassigned or returned to a funder which will come at a cost.

Finally, you will want to think about whether you will operate a company car scheme that is open to all employees or it is restricted to particular groups. The cost of purchasing or leasing a number of vehicles can quickly add up and so limiting the initial number of eligible employees can help you manage this expenditure.

Tax Implications of Company Car Schemes

There are a number of different tax impacts that various company car schemes have and we’ve gathered these below to help you make an informed decision.

National Insurance

Class 1A national insurance contributions are paid on the taxable value of vehicles and fuel provided to employees.

This is charged at a rate of 13.8% and as an employer you must use the car benefit and fuel scale charges when doing calculations on these.

Depending on the scheme you opt for then you may also have reductions on your national insurance contributions for a particular employee, for example if you offer and they opt for salary sacrifice this will lower their pre-tax salary and so the amount of national insurance you will need to pay.

Capital Allowances

Capital allowance is available on company cars provided they are used solely for business purposes which allows your business to deduct some of the expenditure from pre-tax profits.

Company cars are excluded from business’ annual investment allowances so you must claim using writing down allowances.

The amount you will be able to deduct will depend on the vehicle and its emission levels.

Enhanced Capital Allowance

On vehicles you purchase you are able to claim enhanced capital allowances in addition to the standard allowances, these allow you to claim a 100% write-down for the first year. In order to qualify vehicles must be electric or ultra-low CO2 emissions, with levels under 75 g/km, as well as be brand new.

VAT

VAT can be recovered on some funding methods.

Vehicles sourced through contract hire have monthly payments and you can reclaim 100% of the VAT charged on these payments if the vehicle is solely used for business travel or 50% for those also used for personal travel.

Similarly, with a vehicle funded via contract purchase you will not be charged VAT on the monthly payments.

VAT can also be recovered on any fuel purchased for business purposes, including when an employee pays for the fuel and claims it back via expenses. VAT on fuel brought by employees for private use can be recovered but will be paid using the fuel scale charges, which are based on CO2 emissions.

Tax Free Benefits

There are some other aspects of having a fleet of vehicles where you will be able to get some tax benefits.

You will be exempt from paying tax on:

- Vehicle insurance

- Repairs

- Road tax

- Maintenance costs

How to Set Up a Company Car Scheme

Wessex Fleet can help you set up a company car scheme if you need any help or would like to discuss your options and which might work the best for you.

Before you set up your scheme, whether you do it with us or not, there are a number of questions you will need to know the answers to. These are:

- What kind of vehicles will you offer employees?

- How will you fund the company car scheme?

- How many employees will benefit from the scheme? And in turn how many vehicles will be needed?

- What is the estimated annual mileage?

- What are any tax implications?

- Will you put in place any restrictions on the vehicle choices or use?

- Will you opt for a maintenance service for your fleet?

What Types of Cars Should a Company Offer?

You can offer any car or van that you think is suitable for your employees however there are a few things to consider.

The first is that vehicles with lower CO2 emissions will cost less in company car tax for you and your employee - which means that choosing an electric vehicle will save you both money.

If you or your drivers are not ready to go fully electric then a hybrid, especially a plug-in hybrid (PHEV), will have lower CO2 than a purely petrol or diesel model.