What is a Company Car?

There are a number of different schemes that businesses can offer to provide you with the use of a company vehicle or funding one for you, and we’ve got a detailed guide to them here.

The most common that you’ll find is a company car, where the car is in the business name but is yours to drive.

This can be solely for business use or for personal travel as well, however if you also use the vehicle for personal trips as well then you will need to pay company car tax for it.

Benefits of a Company Car

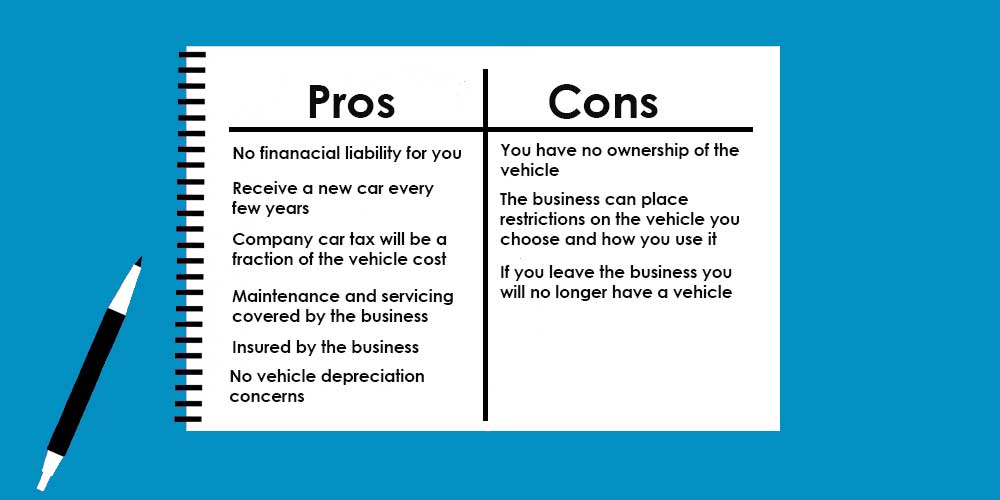

Deciding if a company car is the right choice for your needs can be a complex decision so we’ve rounded up the pros and cons to help you in the decision-making process.

- As the vehicle is in the business’ name there is no financial risk or liability for you personally

- The amount you pay in company car tax is a fraction of the cost that you would have had if you’d taken on the vehicle finance yourself

- Most company vehicles include maintenance and servicing, as well as insurance as part of the cost covered by your employer

- You will usually get a new car every few years

- As you don’t own the vehicle you have no vehicle depreciation costs to worry about

Other Things to Consider

Though there are many financial benefits to having a company car there are other factors you’ll need to take into account when deciding if you want to have one.

The first thing you need to look at is your business’ restrictions, as they are the owner / lease holder of the contract they may set additional restrictions including the models you can select from, the annual mileage, and vehicle checks you need to complete regularly.

Another thing to bear in mind is that the vehicle will be in the company’s name so if you leave the business then you will no longer have use of the vehicle.

Company Car Tax

If the vehicle is available for your personal use, which includes the journey to and from work, then you will need to pay company car tax on the vehicle.

You can find a full breakdown on this benefit in kind (BIK) tax and how to calculate this here but an important thing to be aware of is that this is based in part on the vehicle’s value, including any additional extras you have opted for, as well as its CO2 emissions.

When choosing a car for your company vehicle we recommend checking the vehicle value, also known as the P11D, and the CO2 emissions so you can also factor in how much the company car tax will be and how this might affect you.

For more information on choosing the right car and whether a company car is the right option for you then check out this guide or give us a call on 01722 322 888 to speak to one of our helpful advisors.