We know that when you’re offered vehicle benefits from an employer it can be difficult to work out which is the best option for you, which is why we wanted to put together this helpful guide to the different funding methods that could be available.

This guide will look at the three main options available in the UK:

Each of these are a benefit that your employer might offer but you also have the option of finding and funding your new vehicle independently of any work benefit you might receive.

Depending on your circumstances sourcing and looking after your vehicle independently of any company benefits might be the best option for you personally. Each individual’s circumstances are different and ultimately it will be up to you to decide whether accepting a vehicle benefit is the best choice for you and if there are various options available to you the right one.

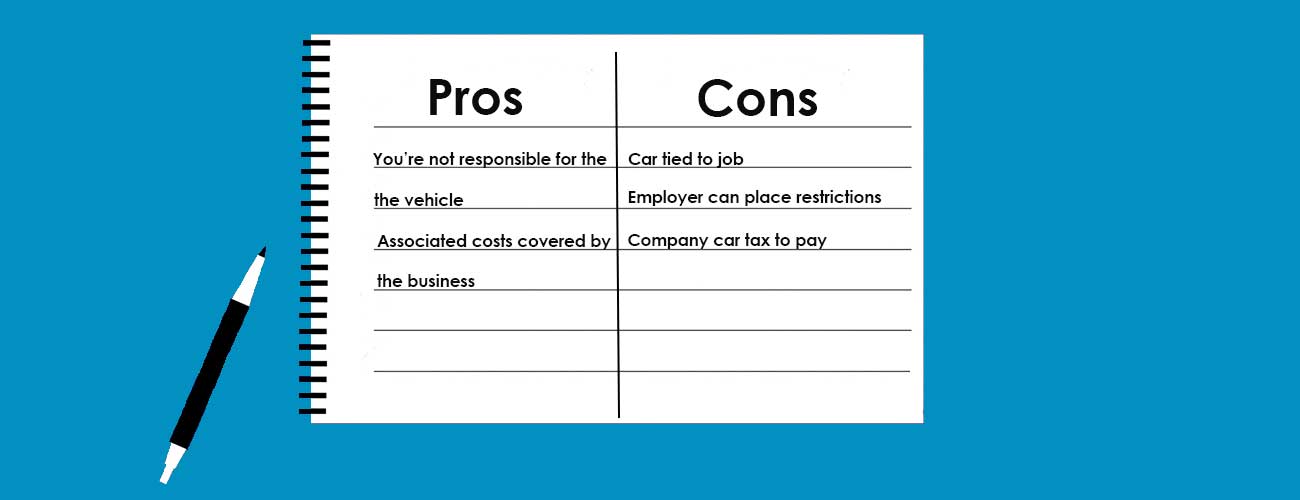

Company Car

This section of the guide will cover the company car, and van, what they are, the benefits of taking one, things you need to be aware of and the financial implications.

What Is a Company Car?

A company car is a car that is provided to you by your employer to use. This can be solely for business journeys or also for your personal travel.

Depending on your role within the business you might not be offered a company car but instead a company van to drive. The benefits of this will be similar however the way they are taxed will be different, which is something to bear in mind.

Benefits of a Company Car

There can be many benefits to accepting a company vehicle, especially if you are able to use it for your private journeys as well.

Firstly, if you are able to use it for private journeys then you will no longer need to keep a separate private vehicle as well which will save you money.

A company car will be maintained, serviced, taxed, and insured by the business which means you will not need to pay these additional costs associated with vehicle ownership either. Not only is that a financial benefit but it can also reduce the stress that comes with managing a vehicle.

Taking a company car also means that you have guaranteed transport and do not have to worry about your vehicle breaking down and being unable to afford repairs so relying on other modes of transport during that time. Or if you do not currently have your own vehicle it offers you the freedom that comes with a car, to travel where you want when you want without relying on public transport timetables.

Company Car Tax

If your company does provide you with a car you are able to use outside of business journeys then you will be required to pay company car tax. This can also be known as Benefit in Kind (BIK) tax.

It’s important when deciding on whether to accept a vehicle you think about the company car tax and factors which it is based on to see whether it is economically the best choice for you.

The tax will usually be deducted from your monthly salary so will reduce your take-home pay.

Company car tax is calculated using three factors:

- The vehicle’s emissions

- The vehicle’s P11D (the vehicle’s value including any additional extras but minus the non-taxable items)

- Your personal tax band

So, you’ll need to consider the emission level and value of any vehicle offered to you, so you can calculate the tax you will be paying and whether this makes financial sense for you.

For a more detailed breakdown on how company car tax is calculated take a look at this dedicated guide page on it.

We mentioned above that company van tax is calculated differently and so if you are being offered a van then you will need to think about the company van tax rather than company car tax. This is calculated using a fixed amount, which is currently £3,500 for the 2021/22 tax year, and then multiplying this by your personal tax band to get the annual amount you’ll pay. Again, this will then be divided into monthly payments deducted

What are the Driver Responsibilities with a Company Car?

Although your employer will be responsible for a lot of the tasks associated with vehicle ownership as the driver there will still be a level of responsibility that falls to you.

You are the one who interacts with the vehicle regularly and so you will usually be asked to complete some basic maintenance checks and work to ensure it runs correctly. These will usually include checking the fluid levels, tyre condition and pressure and general vehicle condition.

You’ll also be responsible for flagging with your fleet manager when any repairs are needed, or any warning lights appear on the dash for maintenance or servicing work.

Company Car Driver Restrictions

As well as requiring you to have a level of responsibility for the vehicle your employer might place restrictions on your company car. These can be in terms of what models are available for you to choose from through to how the vehicle is used and the condition it should be kept in.

The exact restrictions will be decided by your employer so we cannot advise on what these will be but to give you a guideline below are some general restrictions we see applied:

- The emission levels of vehicles available to choose from

- The value of vehicles available to choose from

- The annual mileage

- Maximum speed limits

- Vehicle parking conditions

We would recommend checking with your employer any restrictions that they have in place before accepting a company car.

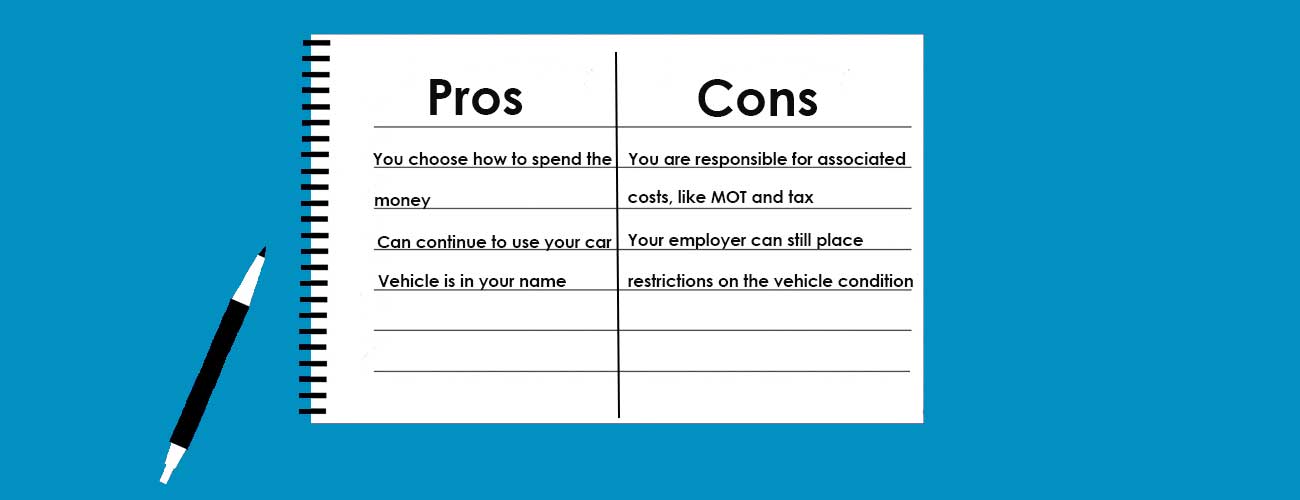

Car Allowance

A company car allowance is a type of cash allowance given to you by your company in order for you to source and maintain a vehicle.

When you receive a company car allowance it is up to you how the money is spent, provided it goes towards keeping you mobile, and so you can decide whether you use towards an existing vehicle or for a new one.

The most common ways that a car allowance is spent is:

- To make payments towards an existing vehicle lease or finance agreement

- For maintenance, servicing and repair work on an existing vehicle

- To take out a finance lease or agreement

- To retrospectively offset the cost of buying a new vehicle outright in full

It’s important to remember that as the vehicle will be in your name the other responsibilities of vehicle ownership will fall to you as well.

A car allowance will usually be paid to you as a monthly allowance alongside your regular paycheque. There are some companies who pay it as an annual sum so you

Benefits of Car Allowance

The most obvious benefit that a cash allowance like a car allowance provides you with is the freedom to spend the money in the best way possible for you.

So, if you already have a car that you like driving and is suitable for the driving you will need to do as part of your work role then you can take the car allowance and use the money provided to keep up with any maintenance and repairs, or to offset some of the other costs such as fuel, insurance and tax.

Another benefit is that as the vehicle will be in your name then you can decide what vehicle you have and are not limited by what fits into the emissions and value limits of the business.

What to Bear in Mind with a Car Allowance

As the vehicle will be in your name it is your responsibility to look after it. This does not just mean ensuring it is in a road worthy condition but also that the MOT is completed, the vehicle is taxed and insured, and you pay any other charges such as the congestion charge when travelling in London.

It will also be your responsibility to ensure that the vehicle is in a roadworthy condition and in line with any requirements that your business has for vehicles, as although the vehicle will be yours with it being used on company travel they may still have certain requirements it will need to meet.

For more information on car allowances you might want to take a look at this guide or you can always give us a call on 01722 322 888 if Wessex Fleet are your management company.

What Tax Do I Pay on Car Allowances?

You will not pay company car tax on a car allowance as it is classed as a cash allowance.

A cash allowance is taxed with your salary in line with your personal income tax bracket and so you will also pay national insurance contributions.

If you are near the higher tax band then you should keep this in mind as they are grouped together and so the cash allowance could push you up into the next bracket and so cost you money.

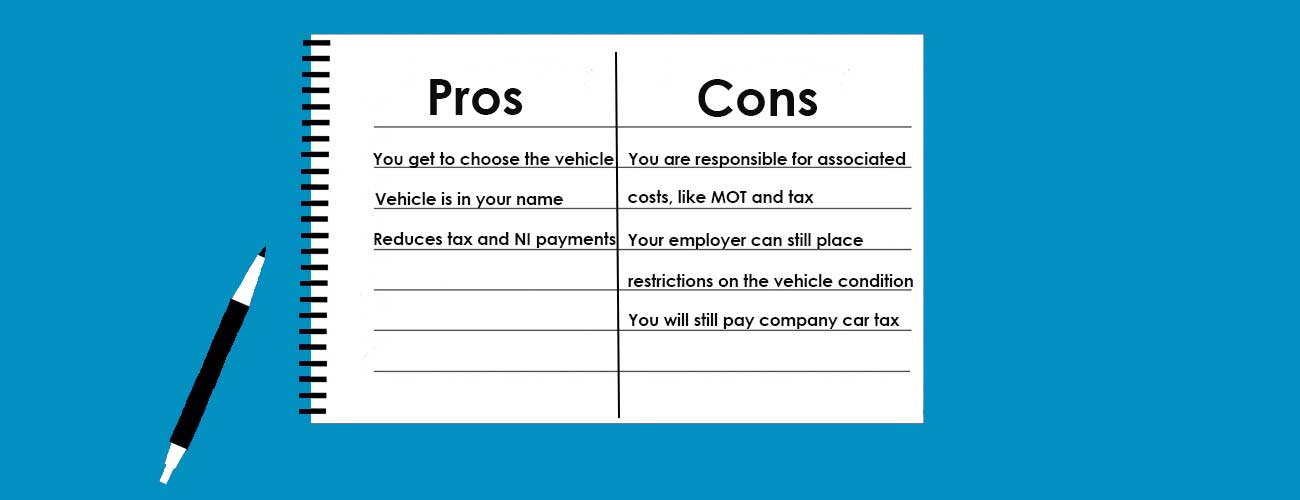

Salary Sacrifice

What is a Salary Sacrifice?

A salary sacrifice vehicle works in the way as any other salary sacrifice benefit where you will exchange a percentage of your gross salary for a benefit with a monetary value such as a car.

With a salary sacrifice car, you will lease the car from a third-party supplier who has partnered with your employer and the amount of the lease will be what is deducted from your monthly salary.

As the vehicle is in your name, you will be responsible for ensuring that it is in a safe roadworthy condition, any servicing and maintenance work is completed promptly and that it is insured, as well as any additional conditions your employer may require.

Benefits of Salary Sacrifice

As a salary sacrifice comes from your gross salary it will reduce the amount you pay in tax and national insurance contributions. Depending on how close you are to the lower tax band it could even drop you down to the next bracket.

As it will usually be a lease vehicle that you receive, this will be a brand-new vehicle that you’ll be able to select from the latest models on the market. With a lease you also benefit from the finance company paying the road tax, at the initial tax amount, so don’t need to worry about this during your agreement.

You will be able to choose which car you drive, although your employee may ask you meet certain requirements such as a lower emission level, and will have the freedom to select a model that best fits your life.

Salary Sacrifice and Tax

A salary sacrifice vehicle will still be taxed as a company car. This means you will need to pay company car tax, also known as a benefit in kind (BIK) tax.

Company car tax is calculated based on the vehicle’s value, including any additional items but minus the non-taxable ones such as the first year’s road tax, the vehicles emission levels and your personal tax band. So, it’s important to keep in mind that as well as the salary deduction you will also have this tax to pay.

For a detailed guide to company car tax and how you calculate it, click here.

Please note that if you use a salary sacrifice for a van then the company van tax you pay will be calculated differently, using a fixed value that is multiplied by your personal tax band. Take a look at our company van tax guide for more information on this.

What to Keep in Mind with a Salary Sacrifice Car

You will be responsible for the vehicle as it is in your name and so you’ll be the one who needs to ensure the vehicle is in a safe roadworthy condition.

You will also be the one who needs to arrange and pay for any servicing and maintenance work, MOT the vehicle if it is over three years old, insure the car and any other associated costs that may arise.

Your company may still require you to choose a vehicle which fits within certain guidelines. For example, if they are transitioning to an electric and low emission fleet you may be required to choose a vehicle with lower emission levels.

Using Your Own Vehicle for Company Travel

You might decide that accepting a car benefit is not the right choice for you and instead continue to use your personal vehicle for all travel, including any journeys that are necessary for your job.

If you do decide to do this then you might be required to maintain your vehicle to a particular standard by your employer in order to ensure it is fit for purpose and that you are not putting yourself or others in danger when operating it.

When you use a personal vehicle it will obviously be your responsibility to keep it serviced and maintained as well as making sure that it meets the legal requirements with the MOT, insurance and road tax. However, you will also be able to choose the model that is best for your needs in your personal life or continue to use the vehicle that you already have.

You will also have the vehicle if you change employment, which is not always the case if you take a vehicle benefit from your employer.

What’s the Right Car Benefit for You

We’ve explored the pros and cons of company cars, car allowances and salary sacrifices above to help you decide what the right option for you is but ultimately it’s up to you to consider your individual circumstances and see what will be the best choice. You may decide that none of these are beneficial to you and instead continue to use your private vehicle for business travels.

If your company’s fleet is managed by Wessex Fleet and you’d like to discuss your options and how they could work for you then you can give us a call on 01722 322 888.