We know that it can be exciting when you’re offered a company car and are able to use this on personal journeys.

There are many benefits to having a company car and we’ve looked at them all in this guide but one major factor to consider is the company car tax you will need to pay.

What is Company Car Tax?

Company car tax, also known as a Benefit in Kind (BIK) tax, is the tax that any driver will pay on a vehicle that is provided for them to use by their employer.

How Does Company Car Tax Work?

Company car tax will only be applied if the vehicle is used for personal travel, which is also known as private use.

If the vehicle is only used whilst at work and for no personal journeys, then you will not need to pay company car tax. A common example of this would be a delivery driver who only uses the van to transport goods and then uses a personal vehicle for their out of work driving.

Company car tax will be paid from your salary rather than you being invoiced and having to pay a bill and will usually be deducted as a monthly amount from your pay cheque.

How is Company Car Tax Calculated?

Company car tax is based on three main factors:

- The P11D of the vehicle

- The CO2 emissions of the vehicle

- Your personal tax rate

The P11D value is the price of the car, including any extra features and fittings added to the vehicle, but minus any non-taxable parts such as the first year’s road tax and first registration fee. Please note that the P11D is based on the manufacturer’s list price rather than the price the company pays for the vehicle, which means that even if it is sold at a discounted price the P11D will remain the same.

Vehicles are put into a band based on how much CO2 they emit, and this will be used to determine the vehicle’s company car tax rate.

Personal tax rates are usually set at 20%, 40%, or 45% but we always recommend looking at a payslip or checking with your accounting department to ensure you have your accurate current rate.

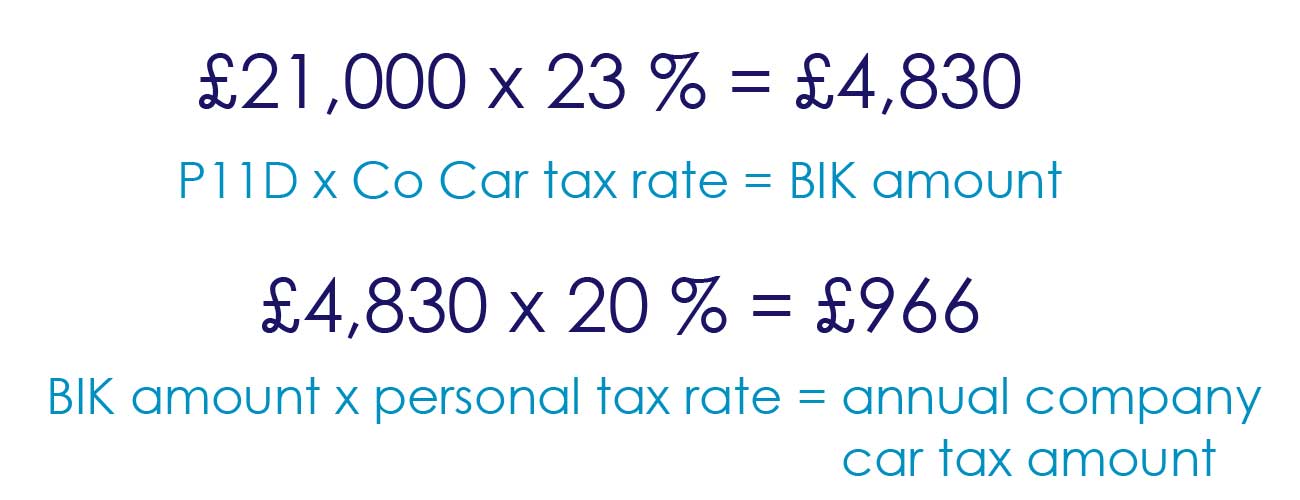

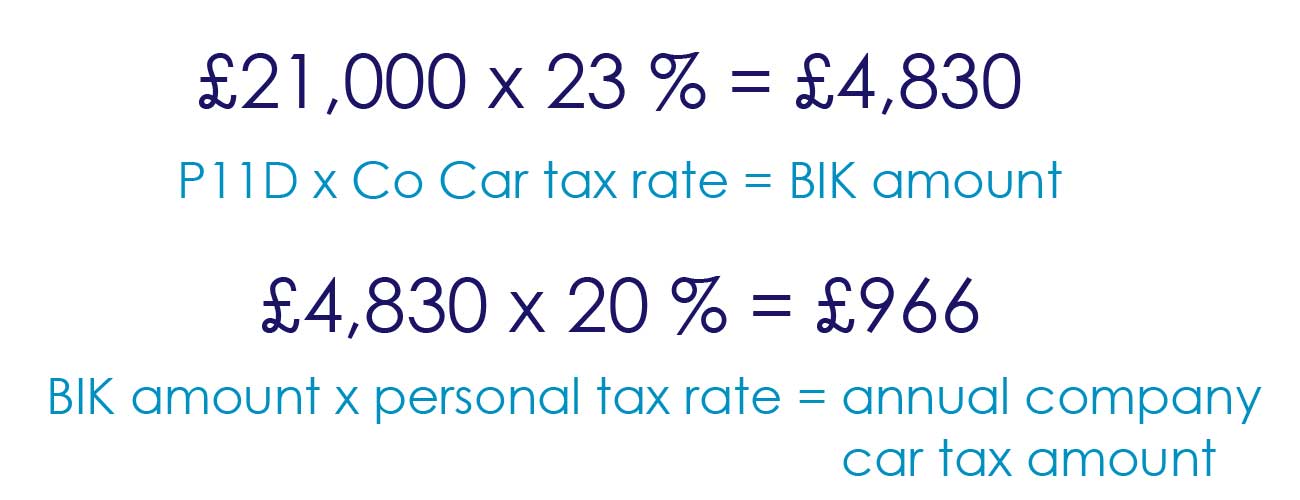

To calculate how much tax you will pay on a company car you should first multiple the P11D by the company car tax rate to give a total BIK amount. For example, if a car has a P11D of £21,000 and a company car tax rate of 23% the BIK amount will be £4,830.

Then to work out how much you will need to pay you’ll multiply this by your personal tax rate. So, if your tax rate was 20% in this scenario you’d multiply £4,830 by 20% to get £966. This will be the amount payable for the year.

Company car tax is usually deducted monthly from your pay to spread the cost throughout the year.

If your company car is being arranged with Wessex Fleet then you can get in touch and we’ll help you work out the company car tax you’ll pay on each model that you’re considering.

You can also use HMRC’s company car and fuel tax calculator.

Company Car Tax FAQs

As a provider of company cars we get asked a lot of questions about company car tax to help drivers decide whether taking a company car is the right choice for them so we've rounded up some of them here to help you too!

Can I Get a Reduction on My Company Car Tax?

There are a few circumstances where drivers will be exempt from having to pay company car tax which include:

- Driving a pool car that is used by multiple employees

- Only using an assigned vehicle for business travel

- If you use a vehicle that has been modified for a disability

Otherwise, the only way to reduce the amount you're paying in company car tax would be to choose a less expensive or lower polluting model.

What Are the Most Expensive Cars to Pay Company Car Tax On?

The most expensive cars to pay company car tax on are generally the more expensive cars themselves as they will have a higher P11D value which is one of the determining factors in calculating company car tax.

Additionally, if you opt for a model that emits more CO2 then you will be paying more so high polluting (generally those with a more powerful engine that has lower fuel economy) will cost you more.

Do You Pay Company Car Tax on EVs and Hybrids?

Yes, but at much lower rates.

Until 2021, EV's did not have a BIK percentage charge but this has risen to 2% for this financial year.

For hybrid models, the BIK percentage rate depends on the distance they can cover in a purely electric mode so depending on this you can still get a massive discount on the company car tax you pay for a hybrid over a petrol or diesel model.

Do Diesel Cars Pay Extra in Company Car Tax?

Diesel vehicles traditionally emit less CO2 emission than their petrol counterparts which might lead you to think they'll have a lower BIK rate however there is a 4% diesel surcharge on diesel cars that do not meet RDE2 emission standards. This means that in general you will end up paying more if you opt for a diesel company car.

Other Taxes

Company car tax isn’t the only BIK tax you might be charged if you decide to take a company vehicle.