What is Company Fuel Tax?

Company fuel tax is a Benefit In Kind (BIK) tax that you will pay on fuel provided to you by your business to use when making personal journeys.

This is a similar tax to the one you will pay on the company car for the use of a benefit provided to you by the business. Depending on your fuel consumption, the amount of company fuel tax you’ll pay and other life factors you might find that receiving a fuel benefit from your company is the right choice for you. It’s important to be aware that that having your employer pay for fuel and then paying company fuel tax might not be the best choice for every driver.

Who Does Company Fuel Tax Apply to?

Company fuel tax is applied when your company provide you with free fuel to use in your company vehicle that you are able to use for personal travel as well as business travel.

This applies to all employees who are provided with free fuel and it's important to note that even if you only have the benefit for part of the year you will pay company fuel tax for the full year.

Who Does Company Fuel Tax Not Apply to?

There are a few cases when drivers will not need to pay company fuel tax.

The first is if you are only using the vehicle for business purposes so no fuel is used on private travel. So if you use a company car or van for work but have your own private vehicle that you use and fuel yourself outside of this then you will not need to pay company fuel tax. This is because the fuel in the company vehicle is being used in the course of your job and so is not classed as a benefit.

If you have a company vehicle that's been adapted for a disability and is only used for commuting to work then you will not need to pay fuel tax. However, if you do any additional personal travel outside of that then you would still need to pay company fuel tax.

Additionally, if you are driving a pool vehicle then you will not be charged fuel tax as you will only have the car for a short period and it is assumed it will mostly be used for business travel.

The other time you won't need to pay company fuel tax is if you pay for your own fuel and are reimbursed by your employer for business miles.

When Will I Pay it?

You will pay company fuel tax on any fuel that is used for personal travel.

Please note that under the current government classification driving to and from work would be classed as personal travel.

In terms of when you make the payments, this will usually be deducted from your salary in monthly payments just as other taxes are and so you will not notice one lump sum be deducted but rather a small decrease in your monthly take-home pay.

Company Fuel Tax Exceptions

There are some cases where you will not need to pay company fuel tax, which are:

- If you pay for your own fuel and are reimbursed for the cost of business travel by your employer

- If the vehicle is not used for personal journeys

- If the vehicle is adapted for disabilities you have then you might be exempt. Check on the HMRC to see in which circumstances you would be exempt

- If you are using a pool car that remains on site overnight

How is Company Fuel Tax Calculated?

The first thing you will need to know to work out the company fuel tax is your vehicle’s BIK rate.

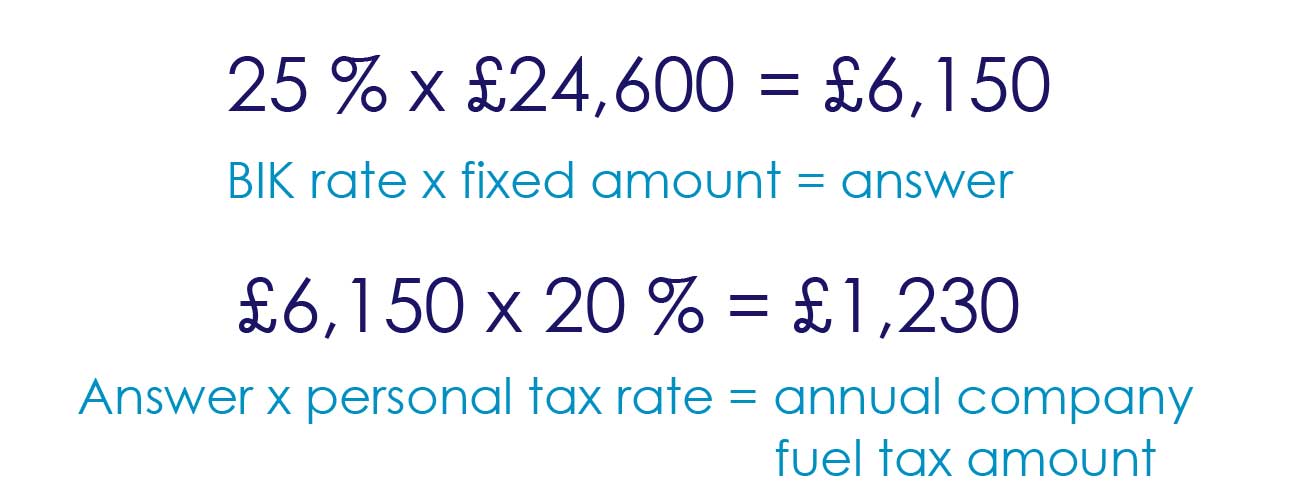

This is then multiplied by a fixed sum which is currently £24,600 for the tax year 2021/2022. Then the result of this calculation is multiplied by your personal tax rate to get the amount that you will pay in company fuel tax.

For example, if your BIK percentage was 25% then you would need to multiply £24,600 by 25% which would give you £6,150.

You will then multiply this by your tax margin so in this example it would be £6,150 by 20% for a total payable over the tax year of £1,230.

How Can I Reduce My Company Fuel Tax Bill?

One way to reduce the amount you pay on company fuel, and company car, tax is to pick a model with a lower BIK rate. The BIK rate is based on CO2 emissions so to get the cheapest fuel bill you want to look at a hybrid model or a very fuel efficient petrol vehicle if you're not ready for an electric car just yet.

For more guides including ones that will help you understand everything there is to know about the company car, a company car allowance, and company van tax if you're using a commercial vehicle then head back to our guides homepage

If Wessex Fleet are your fleet manager and you have any questions about your company fuel tax and whether taking company fuel benefit is right for you please give us a call on 01722 322 888.