October 14, 2022

Abby Nuttall

Articles

Here at Wessex Fleet, we’ve been working in the fleet management industry for nearly 20 years so we know what the most frequently asked questions from fleet drivers are and how to answer them.

To help you and your drivers we’ve complied a list of the most common questions we’re asked and how we’d answer them, you can use this as a resource that you tailor to your business’ needs or you can direct drivers to this page themselves. We’ll also point you to some other areas of our site with more helpful information on particular topics. To make it a little easier we’ve broken down the questions into five different sections:

- Questions based on the vehicle

- Questions based on being a company car driver

- Questions about fuel

- Questions based on company car tax

- Questions on clean air zones and emissions

Vehicle-Based Questions

What Do I Need to Do to Look After a Company Car?

The exact answer to this will depend on your company’s policy but there are a few general tips we would recommend you follow:

- Treat the vehicle with the same level of care as you would if you owned it

- Make sure any issues or damage are reported as soon as you spot them, and repairs are arranged promptly

- Be available for maintenance and servicing appointments when requested

- Clean the vehicle regularly

- Complete regular checks that you would do for your own vehicle, such as tyre pressure, fluid levels etc

Who Pays for Company Car Repairs?

Maintenance of your vehicle will usually be covered by the business unless it needs to be repaired due to driver negligence or damage when they may ask you to pay for this, depending on the terms of your company car agreement.

Who Arranges Company Car Servicing?

Most companies will have a fleet manager or department who you will need to contact and they will then arrange for any repairs or servicing on your behalf. Alternatively, they may give you the details to contact your company’s preferred garage so that you can arrange the work to be done at a convenient time for you.

What is the Legal Tyre Depth?

All tyres should have a minimum of 1.6mm of tread across the central three-quarters of the tyre around the entire wheel.

When Do I Need to Get New Tyres?

You’ll need to get new tyres for your vehicle if the tread goes below the legal depth or if there is any visible damage including bulges and cuts or cracks on the surface that cannot be repaired.

If you want to learn more about what to look out for then our guide to checking your tyres can help you.

What is a Vehicle Inspection?

A vehicle inspection or vehicle check is a term used to describe the regular checks that drivers need to complete on a company vehicle in order to make sure that it is safe and roadworthy. These inspections can happen at weekly, fortnightly or monthly intervals and will usually require the driver go around the vehicle completing a visual inspection and fill in a brief report based on this.

How Do I Complete a Vehicle Inspection?

The method of inspection will vary depending on your business requirements and their fleet management team but you’ll generally find that drivers will need to look at particular aspects of the vehicle and complete a report based on these. There may be additional questions about whether there have been any incidents with the vehicle or changes to your ability to drive.

If you’d like to learn more about vehicle maintenance checks for your business we do have a guide that will help you understand what should be included and how to manage them.

Company Car Driver

Who Do I Contact if There’s Something Wrong with My Company Car?

If there is a problem with your company car then the first point of contact will usually be your fleet management team. This may be an internal or external contact and you should keep their details in an easy to access place when they are first provided.

If you are a Wessex Fleet client then our team is reachable on 01722 322 888 or fleetsupport@wessexfleet.co.uk.

What Do I Need to Do for a Company Car?

What is required of you will vary between companies but some general guidelines are:

- To keep the car in a clean, usable and road-worthy condition

- To use the vehicle as intended

- To follow any instructions or guidelines provided by your fleet management team

- To report any damage or issues as soon as they’re noticed

What is a Company Car?

A company car is a car that is provided for you to drive by your employer. They can usually be used for business and personal journeys, though there are cases when company cars are purely for business purposes.

The term may also be applied to vehicle benefits that you receive as part of your employee benefits, for example some businesses choose to refer to a salary sacrifice or car allowance as a company car.

What is a Salary Sacrifice?

A salary sacrifice vehicle is a funding method for you to get a new car by exchanging a percentage of your gross salary for a lease vehicle. You will lease the car from a third-party and this will be paid out of your salary pre-tax.

What is a Car Allowance?

A car allowance is a benefit that some employers offer. They will provide you with an additional amount of funds in order for you to fund a car yourself.

This is one of the more flexible options as you can use the funds to purchase or lease a new vehicle, or pay for maintenance and upkeep costs on your existing vehicle.

What am I Responsible for with My Company Car?

What you are responsible for will depend on your company and the specific vehicle benefit you have. In general you will be responsible for making sure the vehicle is kept in a good condition, any issues are promptly reported and any regular vehicle checks are completed.

What is My Employer’s Responsibility with a Company Car?

Again, this will depend on what your individual company’s policy is but there are some general responsibilities they have as part of their duty of care for you.

As a minimum, if they are providing the vehicle then they will be responsible for making sure it is safe and legally roadworthy for you to use, suitable for you to use and that you’ve received adequate training to be able to drive it.

Will My Company Track My Car?

Your company may have telematics installed on your company vehicles, these systems will be used to monitor car usage and location to protect their asset and to collate data that can be used to help spot potential maintenance issues, better plan routes and support you with additional training if needed.

Why Does My Company Need to Check My Driving Licence?

Your company will usually complete regular checks on your driving licence if you are provided with a vehicle to use or a benefit for one. This will be part of their duty of care for you and other employees, to make sure you are qualified to drive the vehicle.

They will need your permission in order to complete these checks so you will usually be asked beforehand or provide permission for future checks.

Do I Need to Tell My Company if I Get Points on My Licence?

We recommend letting your employer know if you get any penalty points on your driving licence if you receive them while driving a company car. This may be a term of your contract but even if it isn’t we’d advise letting them know so that they can provide additional support or training if you need it.

Additionally, your employer will know how many points are on your licence when they next check it so will be notified at that stage as well.

What is Driver Training?

Driver training is any additional training that your company provides in order to help you drive a vehicle. There is specialist training for using particular vehicle such as forklift training or HGV training or more generalised training designed to help improve your driving overall.

Training can be done virtually, in a classroom or one on one in the vehicle.

Why Do I Need Driver Training?

Your employer may offer or require you to complete training when you are driving a company vehicle. This can be a generalised training or more tailored to your needs depending on your business’ approach to training.

The aim of driver training is to make you a safer and more confident driver to help keep you and others safe. It is not a punishment but a way that your employer can support you.

If you want to learn more about driver training then you can check out our dedicated driver or fleet management guide.

Can I Keep My Personal Plate on a Company Car?

This will depend on your company’s own policy but yes it is possible to have a personalised plate transferred to a company car if your business allows it.

The funding method will have an impact on the process you will need to follow to add your plate to the vehicle. If your company car is a leased car then we’ve got a personalised number plate guide that you should read.

Fuel

What is a Fuel Card?

A fuel card is simply a payment card that can only be used to by fuel, and for some associated vehicle products.

Companies will usually offer a fuel card to drivers who travel a long distance as part of their role or as part of a benefits package.

How Do I Get a Fuel Card?

You will only be able to get a fuel card if your business offers them and you are eligible for one. If you want to find out if you can get a fuel card and how to do this then you’ll need to talk to your fleet manager.

Do I Have to Take a Fuel Card?

If you are offered a fuel card then you do not have to accept this unless you want to. Your fleet manager will be able to advise on the benefits of a fuel card and why one might benefit you.

What are the Current Fuel Advisory Rates?

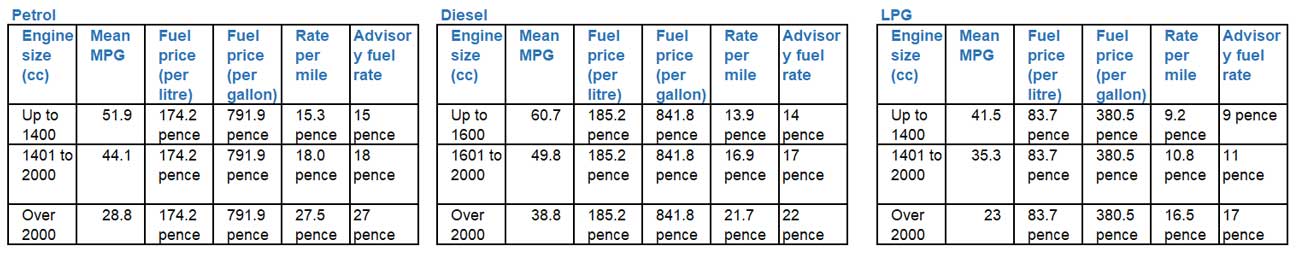

The current advisory fuel rates are:

For electric vehicles the rate is currently 5p per mile.

What is Company Fuel Tax?

Company fuel tax is a tax you’ll pay on fuel provided by your business for personal travel. It is similar to company car tax in that it does not apply to fuel used for business journeys.

Who Pays Company Fuel Tax?

Any driver who’s employer provides them with free fuel will need to pay company fuel tax if they also use that fuel for their personal trips.

For more information on company fuel tax then we’ve got this handy guide.

What’s the Best Fuel for Company Car?

The best fuel type for your company car will depend on your individual needs.

Electric vehicles are currently a great choice for company car drivers as they have very low company car tax on them compared to petrol or diesel models. If you’re concerned about charging an EV or have to cover long distances regularly then a diesel might be a better choice, though it comes with a higher company car tax band.

IMAGE

Company Car Tax

What is BIK?

BIK or Benefit in Kind is the tax an employee pays on a benefit provided to them by their business. When it comes to vehicles this is also known as company car tax or company van tax.

What Is Company Car Tax?

Company car tax is another name for the BIK tax you’ll pay on a company vehicle. This is the tax you’ll pay for being able to use your company car on personal trips.

How is Company Car Tax Calculated?

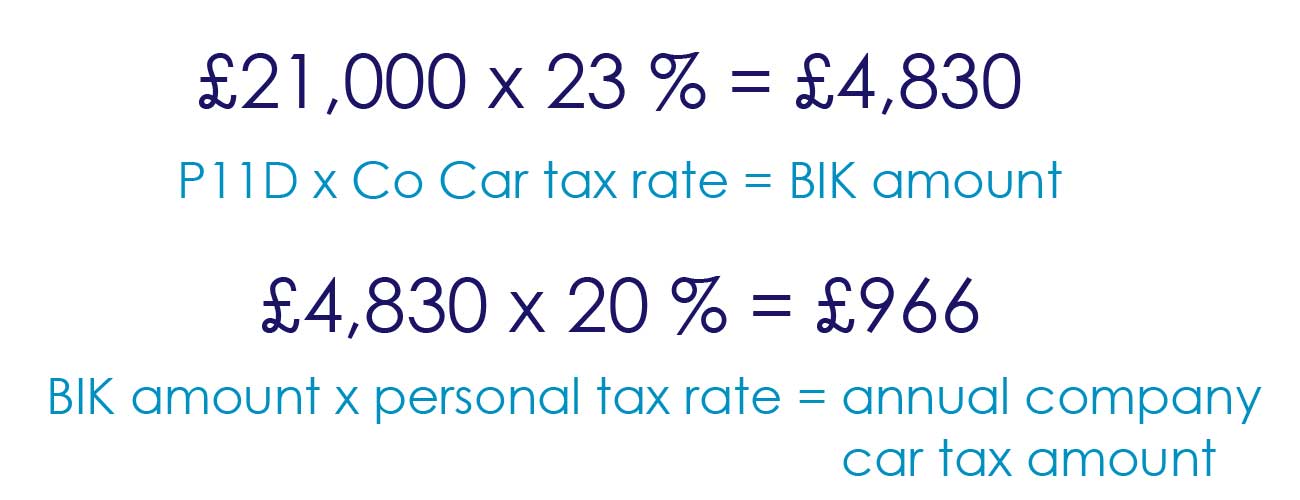

The BIK rate for a car is calculated using three things:

- The P11D of the vehicle

- The vehicle’s company car tax rate

- Your personal tax rate

In order to get the vehicle’s company car tax rate you’ll need to know the CO2 emission levels as these are used to place the vehicle in a rate band.

Once you have these three figures then you’ll need to do the below calculation:

How Do I Know My BIK Rate?

Your personal tax rate will be used as part of the BIK calculations and this will simply be your usual tax rate. So if you’re taxed at 20% on your income then you’ll use 20% in the above calculation.

What is P11D?

The P11D is the price of the car, including any additional options or fittings you have added to the vehicle but minus any non-taxable components such as the first registration fee.

How Do I Know the P11D?

You’ll be able to get the P11D from the new vehicle supplier.

If your vehicle is managed by Wessex Fleet then give us a call on 01722 322 888 and our team will be able to confirm the P11D for you.

How Do I Know the CO2 of a Car?

The supplier of your new company car will also be able to confirm the CO2 emissions of the vehicle. Again, if your vehicle is managed by Wessex Fleet then give us a call on 01722 322 888 and our team will be able to confirm the P11D for you.

Who Pays Company Car Tax?

You will need to pay company car tax on any car provided by your employer that you are able to drive for personal travel as well.

There is an exemption for drivers who are in a vehicle that has been modified for a disability.

For more information on company car tax make sure you head over to our drivers’ guides and check out our guide on company car tax.

Clean Air Zones & Emissions

Where are the Clean Air Zones in the UK?

As of today, there are currently four cities, excluding London with the Ultra Low Emission Zone (ULEZ), that have clean air zones (CAZs). These are:

- Bath – Class C

- Birmingham – Class D

- Bradford – Class C

- Portsmouth – Class B

Which Cities are Going to Add Clean Air Zones?

There are a few more cities that are due to add CAZs in the near future and these include:

- Bristol – due to go live late November

- Greater Manchester – no live date yet

- Sheffield – early 2023

- Tyneside (Newcastle and Gateshead) – late 2022 to early 2023

What Vehicles Can Drive in Clean Air Zones?

There are four types of clean air zones which are labelled Class A, Class B, Class C and Class D.

Class A – vehicles allowed are buses, coaches, taxis and private hire vehicles.

Class B – vehicles allowed are buses, coaches, taxis, private hire vehicles and heavy goods vehicles.

Class C – vehicles allowed are buses, coaches, taxis, private hire vehicles, heavy goods vehicles, vans and minibuses.

Class D – vehicles allowed are buses, coaches, taxis, private hire vehicles, heavy goods vehicles, vans, minibuses, cars and the local authority can choose to allow motorbikes as well.

How Do I Check if I Can Drive in a CAZ or LEZ?

It’s easy to check if you are able to drive in a CAZ. Simply head over to the government’s website and type in the vehicle registration to find out if you are able to drive in a clean air zone without charge or if you will need to make a payment.

How Do I Pay to Drive in a Clean Air Zone?

You can make a payment on the same government website that you use to check if you need to make a payment.

If you have any other questions or want further help on how to tackle your drivers questions then our Fleet Management Team are available for consultations. You can reach them here or give us a call on 01722 322 888.

Enjoyed this article? Read more of our latest blogs below:

- Why You Should Invest in Dash Cams

- Exploring the Challenges of Creating a Greener Fleet

- How to Reduce Fleet Vehicle Downtime

- Should My Business Invest in Electric Vans

Want to know more about fleet vehicles?

For all our latest news and blogs click HERE.

Or are you looking to understand the company car, fleet management or any other aspect of fleet vehicles? If so, then check out our Guide Pages.